Home » Criteria 2023

Criteria

Each year, the criteria are updated and address the most relevant issues. As the needs of the investor and other stakeholder communities change, the mission of these awards remains the same: transparency creates confidence and therefore builds more value for companies and their stakeholders.

The Transparency Awards are organized by Labrador, a global communications firm specializing in corporate disclosures. Beginning with the 2024 Awards, the awards process will be overseen by an independent Transparency Scientific Committee.

The complete list of transparency criteria

Proxy Statement

01 | The document is available in print PDF format

02 | The document is available in an interactive format on the Investor Relations web page

03 | The print version of the document uses a two-column page layout

04 | The SEC EDGAR version of the document uses a one-column page layout

05 | The top of each page in the print version indicates the relevant section and subsection

06 | Every page footer includes the company name, document title, and year

07 | The document includes a secondary color

08 | The second page of the document is either the table of contents, company overview, or values statement

09 | Voting and general information is presented at the back of the proxy

10 | There is a proxy summary containing compensation and governance highlights

11 | The proxy summary includes a table summarizing the proposals and the board’s recommendation for each one

12 | The CD&A starts with a dedicated table of contents

13 | At a minimum, the CD&A Executive Summary includes a table of the NEOs and provides business highlights

14 | The proxy summary includes a strategy or company overview

15 | A shareholder engagement graphic appears somewhere in the document

16 | The document includes a summary of key governance practices and policies (what we do / don’t do, or list)

17 | The company provides a QR code to access voting options and information about the annual meeting

18 | The company explains how shareholders can submit questions for the annual meeting

19 | The cover includes the time and date of the annual meeting

20 | The Notice of annual meeting includes voting icons (mail, phone, internet)

21 | The letter from the Chairman or CEO (or combined role) includes company or governance highlights rather than just meeting information

22 | There is a letter from the entire Board of Directors

23 | At least 30% of the Board members are women

24 | Each director biography includes a photo

25 | Within each director biography, at least three items (such as tenure, age, and committee assignment(s)) are called out separately

26 | The company discusses its position on diversity beyond the board level (recruiting employees)

27 | The company discusses at what level its ESG initiatives are overseen (management, board, specific board committee)

28 | Committee descriptions include the aggregate meeting attendance rate

29 | The attendance rate disclosed for the entire board is precise rather than the minimum “more than 75%” requirement

30 | Each committee description includes a summary of the topics discussed during the year

31 | Key governance changes or the Board’s areas of focus are clearly outlined

32 | The board evaluation section discusses the results and, if warranted, the proposed enhancements or actions taken

33 | The document discusses the implementation or monitoring of (or responsibility for) a succession plan

34 | The document discusses director onboarding or continuing education

35 | The document includes a link directly to the code of conduct

36 | The company explains its approach to cybersecurity

37 | The letter from the Compensation Committee includes highlights about the compensation program

38 | The document includes a summary of key compensation practices and policies (what we do / what we don’t do, or list)

39 | The CD&A includes a discussion of each individual NEO’s role, performance, and total compensation

40 | The company discloses whether it has a clawback provision for executive compensation

41 | The document discusses human capital management in the ESG/CSR section

42 | Reference to a sustainability framework or the UN Sustainable Development Goals

43 | The company explains why each particular skill is relevant to the company

44 | The company discloses the criteria used to identify the companies in the peer group and shows how the company fits into the peer group with respect to those criteria

45 | The company mentions the prior years’ Say on Pay score within the CD&A

46 | The company uses diversity, environmental, or other ESG-focused metrics in the annual incentive program

47 | The company explains (i) whether it follows a “Rooney Rule,” (ii) whether the rule is a firm policy (in a committee charter or separate document adopted by the Board) or just a commitment, and (iii) which roles (Board, CEO, other executives) the rule applies to

48 | There is an individualized Board matrix that provides diversity information—either alone or combined with skills information

49 | The components of director compensation (including all retainers and equity awards) are disclosed in a table or other easily understood graphic

50 | The CD&A includes a table or other graphic showing the current payout percentages (based on performance to date) for outstanding equity awards

51 | At a minimum, the proxy includes a graphic summary of directors’ ages and tenures

52 | The document includes a director skills matrix

53 | The document includes a separate board committee matrix or discloses committee memberships within a board nominee table in the proxy summary

54 | The document includes a graphic showing the board evaluation process

55 | The document has a CSR or ESG section containing graphics or key figures that describe ESG highlights (diversity, gender parity, carbon emissions, etc.)

56 | Within the director compensation section, a graphic is included to show allocation of various direct compensation elements

57 | A section on business performance highlights (in the CD&A or the proxy summary) incorporates at least two graphics

58 | The CD&A contains at least three graphics depicting compensation of the NEOs

59 | A table or graphic is used to present the target and final results of the short-term incentive plan

60 | A table or graphic is used to present the final results of the long-term incentive plan for the performance that just ended

61 | The document includes a shareholder engagement section

62 | The document includes “human capital management” information

63 | Within the shareholder engagement section, the company includes who from the company participated and how many shareholders were contacted and topics discussed

64 | The document includes a graphic showing stock ownership by each Named Executive Officer compared to ownership guidelines, if any

65 | The distribution of specific risk oversight responsibilities among the Board, Board committees, and management is depicted in a graphic.

66 | There were at least 45 days between the filing and the annual meeting

Form 10-K

67 | The Investor Relations website offers an interactive version of the Annual Report

68 | There is a table of contents on page 2 with two levels (sections and subsections) of detail

69 | The document is available in PDF print format (not a PDF of the HTML)

70 | The top of each page in the print version indicates the relevant section and subsection

71 | Every page footer includes the company name, document title, and year

72 | The document uses a two-column page layout

73 | Item 1 – Business contains an overview of the company’s strategy

74 | The document contains a glossary of terms or key word index

75 | The document includes a secondary color

76 | Item 1 – Business contains a graphic to highlight the company strategy

77 | The tables throughout the MD&A have titles

78 | The Notes to Consolidated Financial Statements have a dedicated table of contents

79 | Within Item 1, the document provides a direct link to the website hosting all of the company’s SEC filings

80 | The “Risk Factors” section begins with a summary of major risks

81 | The “Risk Factors” section is broken into subsections by the type of risk

82 | The company identifies cybersecurity is a major risk

83 | The segments in the Business Overview are an exact match to the segments discussed in the MD&A

84 | The company identifies environmental issues as a risk

85 | Within the human capital management section there is a subsection on employee recruitment and training

86 | The company discloses global workforce statistics on gender

87 | The company discloses workforce statistics on race

88 | Within the human capital management section there is a subsection on employee health and safety

89 | Within the human capital management section there is a subsection on culture and engagement

90 | Within the human capital management section there is a subsection on diversity and inclusion

91 | The MD&A contains at least one graphic to highlight company performance

92 | The document follows a logical structure recommended by the SEC

93 | Each section of the report is labeled with the appropriate name from the regulations (i.e., “Risk Factors,” “Management Discussion and Analysis,” etc.)

94 | There were no more than 50 days between the filing and the fiscal year-end

Investor Relations Website

95 | The homepage of the corporate website includes “Investors” or “Investor Relations” with other prominent level one headings

96 | The Investor Relations search engine is quick and accurate

97 | The IR home page has a menu offering direct access to sub-sections

98 | There is a Sustainability or Corporate Responsibility section clearly identified and accessible from the IR homepage

99 | There is an “Annual Meeting” sub-section that includes access to the 10-K, Proxy Statement and a link to voting

100 | The “contact” page offers an option to send an email to investor relations or a specific contact in Investor Relations

101 | Readers can access the 10-K or Proxy from the IR home page in two (or fewer) clicks

102 | The IR site offers easy and public access to the annual meeting webcast or transcript

103 | The IR site offers an option to register for email alerts

104 | A search for “Company 2021 Annual Report” on any search engine will lead to the current Annual Report in the top five results

105 | A search for “Company 2022 Proxy Statement” on any search engine will lead to the current Proxy Statement in the top five results

106 | There is an “Annual Report and Proxy Statement” subsection that includes a link to PDF versions of the Annual Report or 10-K and Proxy Statement

107 | Readers can access the Proxy from the IR home page in two (or fewer) clicks

108 | The company website’s search engine provides easy access to information related to “ethics,” “strategy,” and “sustainability”

109 | Readers should be able to view the company’s latest earnings presentations

110 | Readers can access the Code of Ethics or Code of Business Conduct from the IR home page in two (or fewer) clicks

111 | The company’s website has a dedicated Ethics and Compliance tab

112 | Readers have access to the last five Annual Reports

113 | The company’s current bylaws are posted and easily accessed

114 | A subsection within the Investor page is called “SEC Filings”

115 | A subsection within the Investor home page is called “Corporate Governance” or “Governance”

116 | The home page of the IR site includes, at a minimum, “Events and Presentations,” “Stock Information,” and “contact or FAQ”

117 | There is a dedicated website or landing page for the Annual Meeting that includes all materials needed for the AGM

Code of Conduct

118 | The document is available to the public on the company’s investor relations or corporate website

119 | The document is available in print PDF format

120 | The document is available in an interactive format, sending the reader to additional content such as a video or intranet for more information

121 | A search for “code of ethics or code of conduct Company name” in any search engine will lead to the most recent document in the top three results

122 | The document is titled either Code of Ethics or Code of (Business) Conduct

123 | The document uses personal pronouns (we, you) rather than titles (the Company, every employee)

124 | The document is translated into three or more languages, not including English

125 | If the document is translated, the translated documents are available on the same landing page as the English version on the corporate website

126 | The document includes a table of contents

127 | The document includes a graphic depicting the reporting procedure

128 | The document includes direct link(s) to other policy(ies)

129 | The company values are presented at the beginning of the document

130 | The document is dated and produced or updated within the last two years

131 | The Code includes a chapter or paragraph about code violations

132 | The section on reporting violations includes at least three ways (phone, email, physical address) to anonymously report a concern

133 | A letter from the CEO and/or the CCO introduces the Code

134 | The Code mentions a training program

135 | Comprehensiveness: at least seven themes included

136 | The company indicates the response time if an incident is reported to the hotline

137 | The company presents the governance structure of the ethics and compliance program

138 | The document says the company has a policy that prohibits retaliation against people who report concerns

139 | The letter mentions (i) the importance of ethics, compliance and integrity, (ii) following the code, and (iii) reporting a concern

140 | The document contains a minimum of three graphics or infographics

141 | The document includes a decision-making tree graphic

142 | The document includes at least three practical case studies or examples (Q&A)

143 | The table of contents is organized by stakeholder group (Employees, Customers & Suppliers, The Company, Community/Society)

144 | A list of the different code(s) or policy(ies) are available on the same landing page as the Code

145 | The document includes a section about the Code’s purpose and who it applies to

146 | The document refers to other policy(ies)

Plain Language

1 | Average sentence length is 20 words or less

2 | 98% sentences or more in active form

3 | 98% sentences or more in affirmative form

4 | 20% or less complex sentences

5 | 15% or less sentences with parenthesis

6 | 7% or less adjectives

7 | 2% or less adverbs

8 | 0.5% or less Latin or foreign words

9 | 0.5% or less elaborate or old words

10 | No more than 80 words in paragraphs

11 | No more than 4 paragraphs on average between intermediate titles

12 | Max 20 words per sentence for bullet points

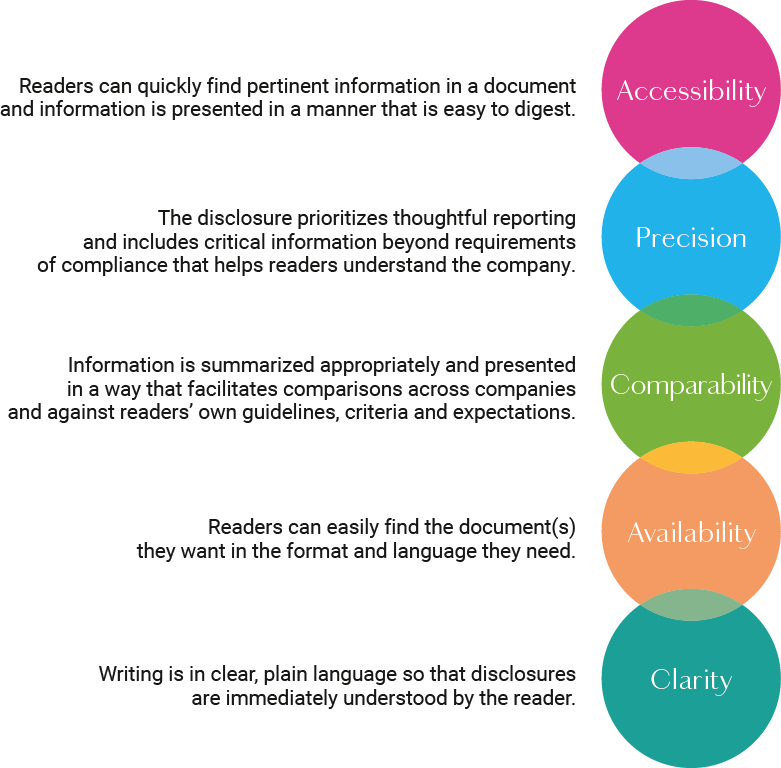

Five Pillars of Transparency

The complete list of transparency criteria

Proxy Statements

- 1 | The document is available in print PDF format on the Investor Relations webpage.

- 2 | The company provides an interactive version with links to navigate to and from sections of the document, including table of contents.

- 3 | The company files a courtesy PDF with the SEC.

- 4 | The cover includes the time and date of the annual meeting.

- 5 | The document includes a secondary color.

- 6 | Every page footer or header includes the company name, document title and year and relevant section.

- 7 | The table of contents is one-page and includes two levels of hierarchy.

- 8 | Voting and general information is presented in Q&A format at the back of the proxy (except in a proxy contest).

- 9 | The company explains how shareholders can submit questions for the annual meeting.

- 10 | The core proposals (election of directors, say-on-pay and ratification of auditors) precede relevant disclosures.

- 11 | The notice of annual meeting is formatted to highlight items to be voted on, voting methods and meeting logistics.

- 12 | The document includes an introductory letter providing an overview of the board’s priorities/focus areas from either independent Board leadership or the full Board.

- 13 | The mission, vision or purpose of the company is presented within the introductory pages.

- 14 | The proxy summary or introductory pages include a table summarizing the proposals and the board’s recommendation for each one.

- 15 | The document includes a company overview section using graphics or other visual elements that includes a summary of company strategy.

- 16 | The company overview section includes business and financial highlights using graphics or other visual elements.

- 17 | The proxy summary or introduction to election of directors proposal includes a board summary matrix, table, graphics or other visual elements that names all directors and includes, at a minimum: each director’s primary occupation; age; independence; tenure; and committee membership.

- 18 | The proxy summary or introduction to election of directors proposal includes graphics presenting, at a minimum: ages; tenures; genders; and race/ethnicities of the full board.

- 19 | The document includes a summary of key governance highlights, practices and/or policies (e.g., what we do/don’t do, best practices list or adoption timeline).

- 20 | Each director biography includes a photo and at least five separately presented attributes (such as tenure, age, independence, other public directorships and committee assignments).

- 21 | Board skills are presented in a matrix or table indicating the skills held by each individual director.

- 22 | Board skills are presented in a matrix, table, graphic(s) or using other visual element indicating the skills held by the board in the aggregate.

- 23 | The relevance of each board skill and its link to company strategy is explained.

- 24 | The board nomination or refreshment process is depicted in a graphic or using other visual elements.

- 25 | Key aspects of shareholder nomination rights are discussed in the context of other governance policies and practices.

- 26 | The document has a dedicated section, subsection or callout explaining the company’s approach to board diversity, including a policy or specific commitments.

- 27 | Board diversity information (individual or aggregated) is presented in a matrix or table.

- 28 | Board committee responsibilities are presented in bullet format.

- 29 | The attendance rate disclosed for the entire board is precise rather than the minimum “more than 75%” requirement.

- 30 | The duties/responsibilities of the Independent Chair or Lead Independent Director (as applicable) are listed in bullet format.

- 31 | The rationale and/or qualifications related to selection of individuals currently serving as Chair and/or Lead Independent Director is explained.

- 32 | The document includes disclosure on the board’s committee chair rotation and selection process.

- 33 | The board’s policies and practices related to director onboarding and continuing education is disclosed.

- 34 | The board evaluation process is depicted in a graphic or using other visual elements.

- 35 | The board evaluation disclosure includes topics assessed and examples of enhancements or actions taken resulting from evaluation feedback.

- 36 | The document includes a dedicated section, sub-section or callout discussing the board’s role in oversight of strategy.

- 37 | The distribution of specific risk oversight responsibilities among the Board, Board committees, and management is depicted in a matrix, table, graphic or using other visual elements.

- 38 | Within the risk oversight section, there is an overview of the enterprise risk management (ERM) process including timeframes for assessing risks (short, medium, long-term).

- 39 | The document includes a dedicated section, subsection or callout discussing the board’s role in oversight of information security/cybersecurity/data privacy risks.

- 40 | The document includes a dedicated section, sub-section or callout discussing the board’s role in management succession planning.

- 41 | The document includes a dedicated section, subsection or callout discussing discusses the board’s role in oversight of human capital management.

- 42 | The document includes a human capital highlights/summary section.

- 43 | The document presents EEO-1 or similar workforce data or states that the information is publicly available and where it is located.

- 44 | The human capital highlights/summary section includes, at a minimum: an overview of the company’s approach to workforce diversity, equity and inclusion; and employee engagement (may be within the ESG highlights/summary section).

- 45 | The document includes an ESG highlights/summary section.

- 46 | The ESG highlights/summary section includes, at a minimum: an overview of ESG focus areas; graphics or key figures that relate to company priorities and initiatives (e.g., key goals and/or progress for carbon emissions, diversity, gender parity, etc.); ESG reporting status, including use of applicable reporting frameworks; and url for most recent ESG report.

- 47 | The document includes a section, subsection or callout discussing the board’s role in ESG oversight.

- 48 | A matrix, table, graphic or other visual elements are used to depict the distribution of specific ESG responsibilities among the Board, Board committees, and management.

- 49 | The shareholder engagement section includes, at a minimum: who from the company participated; how many shareholders were contacted, type of engagement; and topics discussed.

- 50 | The shareholder engagement section includes feedback received from shareholders and actions/responses taken in recent years.

- 51 | The director compensation section discusses benchmarking with peer companies.

- 52 | Pay mix and applicable components of director compensation (including all committee chair retainers and equity awards) are disclosed in a matrix, table graphic or using other visual elements.

- 53 | Director stock ownership requirements are discussed within the director compensation section.

- 54 | The audit section includes an overview of the audit firm selection process / assessment.

- 55 | The CD&A starts with a dedicated table of contents or similar overview of key topics and identifies the NEOs in a table or other visual format.

- 56 | The CD&A executive summary includes prior year say-on-pay results.

- 57 | The CD&A executive summary explains changes to the program for the reporting year or states that there are no changes from the prior year.

- 58 | The CD&A executive summary includes an overview of actual/paid compensation (e.g., incentive payouts, discussion of pay for performance alignment or NEO scorecard/pay summary).

- 59 | The proxy summary or CD&A executive summary includes a summary of key compensation practices and policies (what we do/don’t do, or list).

- 60 | The proxy summary or CD&A executive summary includes a components of compensation matrix, table or graphic that presents, at a minimum: the objective/purpose of each element; metrics and weighting used in incentive programs; and performance periods/vesting.

- 61 | The document includes disclosure of CEO and average NEO pay mix presented as a graphic or using other visual elements.

- 62 | The base salary disclosure includes a table, graphic or other visual element that presents change in NEOs’ base salaries year-over-year or states no change.

- 63 | The annual incentive disclosure includes a graphic explaining how the award(s) is calculated.

- 64 | Rationale for selection of performance metrics used in the annual incentive program for the applicable year is explained.

- 65 | The annual goal setting process (e.g., including how plan goals relate to the annual operating plan, guidance/forecasts or prior year performance) is explained.

- 66 | A table or graphic is used to present performance goal(s) and final results for the annual incentive program for the applicable year.

- 67 | The long-term incentive disclosures include a graphic explaining how the award(s) is calculated.

- 68 | Rationale for selection of performance metrics used in the long-term incentive program for the applicable year is explained.

- 69 | A table or graphic is used to present performance goal(s) and final results of long-term incentive programs with periods completed in the applicable year.

- 70 | Current payout percentages (i.e., “tracking” based on performance to date) for outstanding equity awards are disclosed in a table, graphic or using other visual elements.

- 71 | The CD&A includes a consolidated discussion or presentation of each individual NEO’s role, performance and total direct compensation (e.g., “NEO pay summary” or “scorecard”).

- 72 | Peer group disclosures include criteria used to identify peer companies and a matrix, table, graphic or other visual element showing how the company compares to peers with respect to the criteria.

- 73 | The CD&A includes a table, graphic or other visual element showing stock ownership guidelines for the CEO and other NEOs.

- 74 | CEO pay ratio and pay versus performance disclosures are included in the Table of Contents (or in separate Executive Compensation Table of Contents).

Form 10-Ks

- 1 | The document is available in PDF print format (not only a PDF of the HTML).

- 2 | There is an interactive version that includes links to navigate to and from sections of the document, including table of contents.

- 3 | There is a table of contents on page 2 with two levels (chapters and subsections) of detail.

- 4 | The document follows a logical structure recommended by the SEC.

- 5 | Each section of the report is labeled with the appropriate name from the regulations (i.e., “Risk Factors,” “Management Discussion and Analysis,” etc.).

- 6 | Every page footer or header includes the company name, document title and year and relevant section.

- 7 | The document includes a secondary color.

- 8 | Item 1 – Business contains an overview of the company’s strategy.

- 9 | Item 1 – Business includes a graphic to highlight company strategy.

- 10 | Within Item 1, there is a direct link to the website hosting all of the company’s SEC filings.

- 11 | Within the human capital management section, there is a subsection on diversity and inclusion.

- 12 | Within the human capital management section, there is a subsection on employee recruitment and retention.

- 13 | Within the human capital management section, there is a subsection on employee training and development.

- 14 | Within the human capital management section, there is a subsection on employee health, wellness and safety.

- 15 | Within the human capital management section, there is a subsection on culture and engagement.

- 16 | The company discloses global workforce statistics on gender.

- 17 | The company discloses workforce statistics on race.

- 18 | The “Risk Factors” section is broken into subsections by the type of risk.

- 19 | The company discusses cybersecurity in the context of risk.

- 20 | The company discusses environmental issues in the context of risk.

- 21 | The segments in the Business Overview are an exact match to the segments discussed in the MD&A.

- 22 | The MD&A contains at least one graphic to highlight company performance.

- 23 | The tables throughout the MD&A have titles.

- 24 | The Notes to Consolidated Financial Statements have a dedicated table of contents.

- 25 | The document contains a Glossary of Terms or Key Word Index.

ESG Reports

- 1 | The company publishes a separate, stand-alone ESG (Sustainability or Corporate Responsibility) report annually or biannually.

- 2 | The company provides an interactive document with links to navigate to and from sections of the document, including table of contents.

- 3 | Every page footer or header includes the company name, document title and year and relevant section.

- 4 | The document includes a one-page table of contents that includes two levels of hierarchy.

- 5 | The document has an “about this report” section that gives context for understanding narrative and numbers in the report including at a minimum: the report dates; boundaries (geographic or other); and voluntary ESG frameworks or standards used.

- 6 | The document references SASB (ISSB) standards.

- 7 | The document references TCFD.

- 8 | The document references at least one international sustainability reporting framework.

- 9 | ESG goals and/or initiatives are presented as aligned with UN Sustainable Development Goals.

- 10 | The company provides a contact for ESG-related information or questions.

- 11 | The document includes an introductory letter discussing how ESG is integrated into company strategy from either the CEO, the Board or Chief Sustainability Officer (or equivalent).

- 12 | The mission, vision or purpose is disclosed somewhere within the introductory pages.

- 13 | ESG material topics and overall strategy align with the company’s mission, vision or purpose.

- 14 | An “about the company” section using graphics or other visual elements presents, at a minimum: an overview of products/services; revenue (or similar financial metric); areas of operations and number of employees.

- 15 | An overview of ESG “materiality” includes how “material” ESG topics were determined and prioritized.

- 16 | Stakeholder engagement is discussed, including stakeholder groups engaged, type of engagement and frequency.

- 17 | Within the introductory pages, the document includes a summary of its ESG commitments/highlights.

- 18 | Goals are disclosed for, at a minimum: the company’s highest priority ESG topics.

- 19 | Year over year performance against key quantitative goals is presented.

- 20 | At least 3 years of data is included to show progress against quantitative goals (in place more than 3 years).

- 21 | The document includes an overview of the company’s overall strategy and policies related to its highest priority environmental issues.

- 22 | Environmental issues are integrated into the company’s overall enterprise risk management (ERM) processes.

- 23 | The document discusses the board’s role in oversight of climate risks and opportunities.

- 24 | The company explains how it identifies, prioritizes and manages climate risks and opportunities.

- 25 | Climate risk scenario analysis results are presented or shared via a link to a separate report.

- 26 | Scope 1 and 2 emissions data is reported year-over-year (unless inaugural report).

- 27 | Scope 3 emissions data for reporting year are disclosed.

- 28 | Greenhouse gas/carbon emissions reduction targets are quantitatively disclosed.

- 29 | Greenhouse gas/carbon emission targets are approved by the Science-Based Targets Initiative (SBTi).

- 30 | The company shares how it will meet Scope 1 and Scope 2 goals and targets.

- 31 | The company shares how it will meet Scope 3 goals and targets.

- 32 | The company discusses expectations of suppliers to adhere to its environmental standards.

- 33 | The company discusses its management of water and effluents/waste.

- 34 | The document includes an overview of the company’s overall strategy and policies related to its highest priority social issues.

- 35 | Social issues are integrated into overall enterprise risk management (ERM) processes.

- 36 | The human capital management disclosures include an overview of overall human capital strategy.

- 37 | Company culture and values are presented.

- 38 | Global workforce statistics (full time, part time, and by region) are presented.

- 39 | The company provides a link to its latest EE0-1 report.

- 40 | There is a section or subsection on diversity, equity and inclusion.

- 41 | The document discusses the board’s role in oversight of DE&I strategy and/or risk.

- 42 | DE&I goals are disclosed.

- 43 | DE&I progress against goals are disclosed.

- 44 | Graphics are included to represent gender at the board, senior leadership and associate levels.

- 45 | Graphics are included to represent race/ethnicity at board, senior leadership and associate levels.

- 46 | There is a section or subsection discussing the company’s recruitment and retention strategies.

- 47 | Pay audits and/or pay equity (how often, how gaps are fixed, etc.) are discussed.

- 48 | Voluntary and involuntary turnover rates are disclosed.

- 49 | There is a section or subsection on employee training and development.

- 50 | There is a section or subsection on employee health and safety.

- 51 | There is a section or subsection on employee wellness, well-being or mental health.

- 52 | There is a section or subsection on employee engagement.

- 53 | The document includes an overview of the company’s strategy and commitment to human rights.

- 54 | There is a link or summary of the company’s human rights policy.

- 55 | There is a link or summary of the company’s supplier code of conduct.

- 56 | Supply chain audit and remediation processes are disclosed.

- 57 | The company discusses how it gives back to communities in which it does business and/or employees live (volunteering, philanthropy and foundations, employee giving, partnerships, etc.).

- 58 | The dollar amount of charitable giving, by type, in the current reporting year is disclosed.

- 59 | The company explains how community engagement is tied to its ESG goals and broader business purpose and strategy.

- 60 | The document includes an overview of the company’s overall approach to its highest priority governance topics.

- 61 | The company explains its basic aspects of corporate governance and how ethical business practices undergird ESG strategy.

- 62 | The document discusses the board’s role in ESG board oversight, including which board committees oversee the company’s highest priority ESG topics.

- 63 | A table, graphic or other visual elements are used to depict ESG board oversight, including management/ cross-functional committees that oversee ESG on a day-to-day basis.

- 64 | The company explains how its enterprise risk management (ERM) process includes the assessment/evaluation of ESG topics.

- 65 | The company discusses its ethics and compliance culture.

- 66 | The company states whether it has a Chief Compliance Officer or similarly titled position and who that person reports to.

- 67 | The document includes a link and summary of the code of ethics/code of conduct.

- 68 | The document includes links to other related policies, including at a minimum: anti-discrimination; open reporting/whistleblower (anti-retaliation); and sexual harassment.

- 69 | Open reporting process is discussed, including anonymous reporting programs and anti-retaliation policies.

- 70 | Ethics/code of conduct training requirements are disclosed, including who is trained and how often.

- 71 | The company describes its overall strategy and policies relating to information security (cyber/data privacy).

- 72 | The document discusses the board’s role in oversight of information security (cyber/data privacy).

- 73 | The company states whether it has a Chief Information Security Officer or similarly titled position and who that person reports to.

- 74 | Alignment with national or international standards like NIST or ISO is discussed.

- 75 | Monitoring and mitigation policies and practices related to information security (cyber/data privacy) are disclosed, including how issues are resolved (timeframe, communication to internal and external stakeholders, etc.).

- 76 | Information security (cyber/data privacy) training is disclosed, including who is trained and how often.

- 77 | Quality control and assurance is addressed, which may include a discussion of product safety but could also include user experience, grievance mechanisms and how feedback is used to improve product/services.

- 78 | Policies related to political activity or public policy engagement are disclosed.

- 79 | The company provides a list of trade association memberships, engagement in national or international ESG processes, or other partnerships around material ESG issues, especially those related to industry sector (e.g., involvement in climate policy or SEC disclosure regulations).

- 80 | The company provides a third-party assurance/verification letter(s) for, at a minimum, GHG emissions, water and employee fatalities.

- 81 | The company provides a SASB (ISSB) Index.

- 82 | The company provides a TCFD Index.

- 83 | ESG data is provided for a three-year period (or for the years of reporting, if less than three years).

- 84 | GHG methodology is explained, including at a minimum: what standards followed (such as GHG Protocol) to understand assumptions; financial, operational or other type of control used; entities/assets excluded and why; and any other assumptions needed to understand full context of GHG emissions shared in report.

IR Websites

- 1 | A search for “Company 2022 Annual Report” on any search engine will lead to the current Annual Report in the top five results.

- 2 | A search for “Company 2023 Proxy Statement” on any search engine will lead to the current Proxy Statement in the top five results.

- 3 | The homepage of the corporate website includes “Investors” or “Investor Relations” with other prominent level one headings.

- 4 | The IR home page has a menu offering direct access to sub-sections.

- 5 | The company’s website has a dedicated Ethics and Compliance tab.

- 6 | There is a Sustainability or Corporate Responsibility section clearly identified and accessible from the IR homepage.

- 7 | There is a Company Overview or About section clearly identified and accessible from the IR homepage.

- 8 | The company’s leadership is clearly identified and accessible from the IR homepage.

- 9 | A subsection within the Investor page is called “SEC Filings” and includes a PDF and HTML version of filings.

- 10 | A subsection within the Investor home page is called “Corporate Governance” or “Governance.”

- 11 | The home page of the “Investor” section includes, at a minimum, “Events and Presentations,” “stock Information,” and “contact or FAQ.”

- 12 | The “Events and Presentations” page includes future and past events in chronological order, including archived transcripts or presentations.

- 13 | The “stock information” page includes the company’s ticker and stock quote information.

- 14 | The “contact” page offers an option to send an email to investor relations or a specific contact in Investor Relations.

- 15 | Readers can access the 10-K from the IR home page in two (or fewer) clicks.

- 16 | Readers can access the Proxy from the IR home page in two (or fewer) clicks.

- 17 | There is a dedicated website or landing page for the Annual Meeting that includes all materials needed for the AGM.

- 18 | The IR site offers easy and public access to the annual meeting webcast or transcript.

- 19 | Annual Reports and Proxies from at least the last five years are available on the IR site

- 20 | Readers can access the Code of Ethics or Code of Business Conduct from the IR home page in two (or fewer) clicks.

- 21 | The company’s current bylaws are posted and easily accessed.

- 22 | The IR section offers an option to register for email alerts.

- 23 | The Investor Relations search engine should be quick and accurate.

- 24 | The company website’s search engine provides easy access to information related to “ethics,” “strategy” and “sustainability.”

- 25 | Readers should be able to view and download the company’s latest earnings presentation.

Codes of Conduct

- 1 | A search for “code of ethics or code of conduct company name” in any search engine will lead to the most recent document in the top three results.

- 2 | The document is available to the public on the company’s investor relations or corporate website.

- 3 | The document is available in print PDF format.

- 4 | The document is available in an interactive format, sending the reader to additional content such as a video or intranet for more information.

- 5 | The document is translated into three or more languages, not including English.

- 6 | If the document is translated, the translated documents are available on the same landing page as the English version on the corporate website.

- 7 | A list of the different code(s) or policy(ies) are available on the same landing page as the primary code.

- 8 | Document name is either Code of Ethics or Code of (Business) Conduct.

- 9 | The document is dated and produced or updated within the last two years.

- 10 | The document includes a table of contents.

- 11 | The table of contents is organized by stakeholder group (Employees, Customers & Suppliers, The Company, Community/Society).

- 12 | The document includes an introductory letter from the CEO and/or the CCO.

- 13 | The letter mentions (i) the importance of ethics, compliance and integrity, (ii) following the code, and (iii) reporting a concern.

- 14 | The document includes a section about the purpose of the code and who it applies to.

- 15 | The company values are presented at the beginning of the document.

- 16 | The document is comprehensive, including at least seven themes.

- 17 | The document includes a chapter/paragraph on code violations.

- 18 | The section on reporting violations includes at least three ways (phone, email, physical address) to anonymously report a concern.

- 19 | The company indicates the response time if an incident is reported to the hotline.

- 20 | The document says the company has a policy that prohibits retaliation against people who report concerns.

- 21 | The company presents the governance structure of the ethics and compliance program.

- 22 | The document mentions a training program.

- 23 | The document refers to other related policy(ies).

- 24 | The document includes direct link(s) to other related policy(ies).

- 25 | The document uses personal pronouns (we, you) rather than titles (the Company, every employee).

- 26 | There are at least three graphics or infographics within the document.

- 27 | The document includes at least three practical case studies/examples (Q&A).

- 28 | The document includes a decision-making tree graphic.

- 29 | The document includes a graphic depicting the reporting procedure.